Monday, November 9, 2009

Sunday, November 8, 2009

Ethics: An essay on the understanding of Evil

Alain Badiou

Alain Badiou- Source: Verso

Alain Badiou

Translated by Peter HallwardEthical questions dominate current political and academic agendas. While government think-tanks ponder the dilemmas of bio-ethics, medical ethics and professional ethics, respect for human rights and reverence for the Other have become matters of broad consensus.

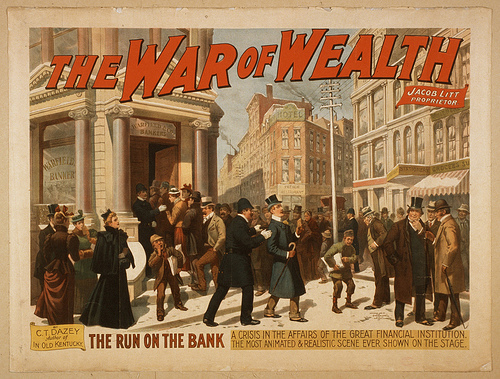

Painful death of the American economic dream

This crisis has been a long time in coming, and history suggests that the period of upheaval will be long and painful, just as it was between 1914 and 1945It wasn't really supposed to end up like this. When the Berlin Wall came crashing down 20 years ago, the cold war ended with triumph for the west.

Friday, November 6, 2009

Nouriel Roubini Doesn't Understand Inflation and Deflation (well well...)

Monday, November 2, 2009

The Simple Life

Αλώβητος ο χρυσός από την οικονομική κρίση

Hμερομηνία : 02-11-09Αλώβητος ο χρυσός από την οικονομική κρίσηΑμείωτη η διάθεση των καταναλωτών να αποταμιεύουν σ' αυτήν τη μορφή.Η διεθνής αγορά του χρυσού που παρά τη διεθνή οικονομική κρίση ενισχύθηκε, επιπλέον διαθέτει και ένα λαμπρό μέλλον, καθώς τα δικά της θεμελιώδη μεγέθη παραμένουν πολύ καλά, όπως παραμένει αμείωτη κι η διάθεση των καταναλωτών να αποταμιεύουν σ' αυτήν τη μορφή, όπως συνομολογήθηκε στη μεγαλύτερη διεθνή σύναξη αυτής της αγοράς στο Εδιμβούργο.

Sunday, November 1, 2009

Sunday, October 25, 2009

Welcome on the Paris Club website

Welcome on the Paris Club website

The Paris Club is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries. As debtor countries undertake reforms to stabilize and restore their macroeconomic and financial situation, Paris Club creditors provide an appropriate debt treatment.

Paris Club creditors provide debt treatments to debtor countries in the form of rescheduling, which is debt relief by postponement or, in the case of concessional rescheduling, reduction in debt service obligations during a defined period (flow treatment) or as of a set date (stock treatment).

The origin of the Paris Club dates back to 1956 when Argentina agreed to meet its public creditors in Paris. Since then, the Paris Club has reached 410 agreements with 86 different debtor countries. Since 1956, the debt treated in the framework of Paris Club agreements amounts to $ 539 billion.

State insolvency (...)

This is the second in a series of articles written by Philip Wood, Allen & Overy's Special Global Counsel, on the financial crisis and the global slowdown from a legal perspective.States are just like everybody else. They can and do become bankrupt. Here is a map showing state insolvencies in the period 1980 to 2005. About 40 per cent of states were insolvent in this period.For the people who live there, the insolvency of their country is a national humiliation. Some vent their sense of helplessness in rancour towards the foreign moneylender and the Washington Consensus. The banking system collapses so that people lose their savings. Inflation and interest rocket. Hopes of happiness are dashed. Bankruptcy is a destroyer.Foreign banks lending in foreign currency are effectively expropriated by a rule of law. This is because, as is almost universally the case, corporate liquidation law converts foreign currency into the local currency at the commencement rate of exchange. If the local currency is depreciating rapidly, as it always is, the claim becomes worthless in nominal terms, even if there were a dividend. So local creditors are incentivised to liquidate, foreign banks are not.So what does the law do about the situation generally?A state is insolvent when it is unable to pay its foreign currency debts as they fall due. Some states are serial insolvents.The medieval history of state insolvencies was one of wars, kings, more wars and ruined Italian bankers. In the 19th century, most insolvencies involved defaults on international bond issues. Some were hardly surprising. The romantic Greek independence loan of 1825 of £2,000,000 (maybe half a billion now) was issued at 56.5%. After deductions of this and that, £245,000 eventually reached Greece, £60,000 in stores. The loan remained in default until 1879. So Byron died for this...

Friday, June 12, 2009

Towards A Sound Economy

Source: LeapBy Rudo de Ruijter*06/06/2009

Sometimes money is compared with the blood of the economy. The credit crisis painfully demonstrated, that the economy depends on a permanent infusion of credits. As soon as the banks deliver a bit less credit, enterprises fail and the mass dismissals succeed each other.

We are made to believe, that the problems with the subprime mortgages were an incident. With a giga-capital injection, a bit more rules and better supervision the banking system would function correctly again. And oh yes, we must trust the banks again.

Main cause of the credit crisis

The main cause of the credit crisis lies in the bank/money system itself. The principle of the money system is, that money is brought into circulation by supplying credit and vanishes again at the moment the credit is paid back. Western banks use two game rules: 1. in comparison with the lent-out amounts, they have to dispose of only 8% of their own capital. [1]; 2. they have to keep a small percentage of reserves in their pay-desk to perform payments for their customers and to hand out cash money.

With these two rules the major part of the money, that customers have in their checking and savings accounts, is lent out (at Triodos bank this is 65% [2], at most other banks much more.) The lent out money is spent by the borrower and subsequently arrives in accounts at other banks. Now, the customers of the first bank can still dispose of their bank balance, while new bank balances have been created at the receiving banks . These new bank balances are the pretext for supplying new credits. This goes on and on. The bank balances are multiplied each time.

This system is called "fractional reserve banking". [3] The banks can fulfil only a fraction of their commitments. They have lent out their customers’ money, although this money can be claimed immediately. They just gamble, that customers will never claim more than they have reserves in their pay-desk and that, if needed, the central bank will come to their rescue. The percentage that banks are not allowed to lend out (the so-called cash reserve) can be determined by law (in the US it was 1:9). In many other countries the central bank dictates the minimum percentage. (Before the crisis, for the Netherlands, I read there was a cash reserve percentage of only 3%.)

Each time a borrower spends money of his loan, the money moves to a following bank, that takes advantage of it to lend out most of it. So, the same money is lent out over and over again. In a 1:9 system the same money can be lent out 9 times. With a cash reserve of 3% it can be lent out 32 times. And each time when it is lent out, a bank collects interest.

The classical risk for banks is, that loans may not be paid back. That risk increases, when fewer new loans are put into circulation than those that are paid back. Then the available money in the country decreases. For the banking industry an environment in which the money supply permanently grows has fewer risks. The central bank sees to it, that the money supply keeps growing (the so called 2% inflation.) When needed, banks can borrow from the central bank, with stocks or bonds as collateral.

When the government borrows money, the amount of money in the country increases, too. Of course, the biggest increase is caused by the multiplier factor, that banks realize themselves. When the multiplier factor rises, loans can be paid back more easily. The income of the bank rises, too. So there is a natural tendancy to lend out higher percentages each time. The banks can also impose more and more requirements on the borrowers to lower the risks. However, the consequences of this dynamic is that the cash reserves decrease.

The purpose of the cash reserves is to supply cash money to the customers and, mainly, to perform payments between the accounts at different banks. When a customer of bank A makes a payment to an accountholder at bank B, a bit of the cash reserve of bank A moves to bank B. And as soon as a customer of another bank makes a payment to a customer at bank A, it increases its cash reserve again. So, the money goes forward and backward between the banks. In the past, it could take three days to make a payment to a customer at another bank. Banks then needed quite a lot of cash reserves. Since then, the payment system has been modernized. Payments go to the destination bank the same day, and the same money can be used for thousands of payments between banks the same day. For mutual clearance of payment orders only a little cash reserve is needed.

The banks have also taken care, that their customers hardly need bank notes (cash) anymore. At first, employers were obliged to pay wages in bank accounts. Everybody at one time got checks or forms for payment orders, which have been followed by plastic payment cards and internet banking. In the Netherlands, for a few years now, the debit card is more and more imposed for all small expenses. For each euro we don’t keep in our pocket, the banks can lend out a multiple amount...

Although a growing money supply is needed to lower the risk of system crashes by failing loans, the multiplier factor ends up causing more and more instability in the money supply and causing smaller cash reserves. As soon as a bank has to book a loss, this not only decreases its capital, but often also its cash reserve. When a bank has less than the 8% required capital (compared to the outstanding loans), or too little cash reserve left, then, according to the rules, the bank has lost the game. The subprime mortgages caused the system to get stuck in 2007, but, in fact, any somewhat bigger losses, like for instance on Third World loans, could have triggered the crisis. The banks simply had too few reserves left to take losses. And once one bank gets in trouble, it can easily spread to other banks, because banks borrow money and buy securities from each other to optimize their balance sheets. The fact that the subprime mortgages were wrapped up as a complex financial product only made the effect bigger. But the main cause of the crisis is not the loss on the subprime mortgages, but the structurally decreased capacity of banks to take losses. And that is the consequence of the natural dynamic within the "fractional reserve banking" system.

Taken hostage

In many countries the governments were called on for help to save the banks. This is remarkable, for the banking system functions outside any democratic control. The directors of central banks took the ministers of finance to international meetings (or took them in) and extracted inconceivably high loans for the banks. All of us, we are guarantors with our future tax money. However, the banks would pay a market conform interest on these loans. To put it otherwise, they will charge their customers for it: you and me. In fact the ministers of finance were put against the wall. The banks were not allowed to fail; they were too important.

The power over the money has been given away by members of parliament in the past. They had no idea about what money was and how the system worked. Now the banks determine how much money there is in circulation and how much the population must pay for this service. The multiplier factor of money also leads to a shift in power within the country: banks make more and more investment decisions, while the government makes fewer. And because there is more and more money available, more and more things become buyable. This has led, for instance, to the dismantling of many state tasks. Services, that are important for the functioning of society, like public transport, post, telephone, water and energy supply have been thrown in the hands of the financial benefit seekers. Private companies would perform better. But in fact, it hides a shift in power due to the "fractional reserve banking".

We still pretend, that we live in a democracy, but the parliament has no say anymore over money, one of the most important factors in society. To get the power over money back inside the democracy only small law changes are needed. Unfortunately, today’s parliamentarians, except a very little number of them, still don’t understand anything about the money system. That is a pity, because by taking back the power over money and with an adequate bank reform, they would be able to stop the credit crisis almost immediately. [4]

Bank reform

Described in short, this bank reform could look like this: the central bank becomes a state bank, part of the ministry of finance. The state bank is the only bank that creates money for loans. The parliament decides which sort of loans must get priority in the interest of society. These loans can be supplied at favorable conditions. This way, the parliament gets much more influence over the shaping of society.

Todays’ commercial banks become server counters for the loans from the state to the public. They manage the checking and savings accounts of their customers on behalf of the state bank. They cannot dispose freely anymore of this money and cannot multiply the balances. However, they will be allowed to collect funds to lend out.

Ethics

If the treasurer of the local sports club would use the money unseen to invest it and enrich himself this way, he takes the risk to be condemned. But when bankers manage the money in our checking accounts in this way, they go free.

The corrupt rules for banks have originated long ago, when gold smiths, and later bankers, were bent upon fooling their customers. [5] The only difference between what happened then and what goes on now is, that the system has become official and the law allows it. Of course, this practice is kept secret as much as possible. You will not find any website of a bank or of a central bank, that clearly explains how a bank works and how the system functions. At schools - except for a few very rare exceptions - the subject is not covered, and even in most economics studies it is not part of the curriculum.

In particular from 1913, after the establishment of the Federal Reserve Bank in the US, the bankers have succeeded in obtaining their own legal framework in many countries and have seized the power over the local money. In each of these countries one bank has been given the role of the central bank. The names of these central banks keep up the appearance, that they are governmental entities, whereas, on the contrary, they became independent from the local parliament and government, be it step by step in some cases: De Nederlandse Bank N.V. (1914), Bank of Canada (1935), National Bank of Danmark (1936), Deutsche Bundesbank (1957), Banque de France (1993), Bank of Japan (1997) and so on. On their bank notes, there were often portraits of kings and statesmen. In many cases the appearance that money would be of the state was corrobated by the fact that the state kept the responsibility to mint coins. On the coins too, there were often trustworthy portraits. When necessary, even religion was invoked. The Dutch guilder coin had the inscription "God be with you" in the side. (Note of Alice Cherbonnier: US money says, "In God we trust.")

Eternal economic growth

It is thanks to the potential for economic growth and the increasing availability of raw materials and energy during the last century, that the money multiplier did not lead to problems, but even pushed the economic growth.

My thesis is, that today’s bank system is a danger to the future of humanity. The permanent inflation, that is inherent to this system, forms an impulse for ever more economic activity in order to compensate for the loss of value of the money unit and to obtain a bit of the additional money put in circulation. In my opinion, this is also where the stubborn believe comes from, that an economy must grow to be healthy (and not, for instance, from a spontaneous desire of the working class to work harder all the time.)

Sustainability, on the contrary, supposes an equilibrium with our environment. Our environment does not grow along with the increase of our economic activity and population. It is destroyed by it. [6]

We need to get rid of our inflationary banking system as soon as possible and put the power over money back where it belongs in a democracy: in the parliament.

* Rudo De Ruijter is an independent researcher based in the Netherlands. For reactions and reply you can contact the author via www.courtfool.info

If you wish, you may copy this article and forward it or publish it in newspapers and on websites.

[1] The 8% capital requirement is the standard from the Basel Accords of 1988, on which all kinds of exceptions apply. This way, for loans with mortgages on housing, banks only need to have a counterpart of capital equal to 4% of the outstanding loans. For loans to other banks the requirement is still lower most of the times and for loans with a state guarantee it is 0% (http://www.bis.org/publ/bcbs04a.htm & http://www.bis.org/publ/bcbs04a.pdf?noframes=1). In 2004 the European Commission proposed to lower the 8% to 6% and the 4% to 2.8% (http://europa.eu/rapid/pressReleasesAction.do?reference=MEMO/04/178&format=HTML&aged=1&language=EN&guiLanguage=en). The Basel II Accords of 2006 offer more possibilities to (big) banks to choose the most favorable method to determine their risks (http://www.bis.org/list/bcbs/tid_22/index.htm)

[2] At Triodos Bank 65% is lent out (http://www.triodos.com/com/whats_new/latest_news/general/response_fin_crisis)

[3] http://www.mises.org/story/2882#3 : see chapters Fractional Reserve Banking, Central Banking, Deposit Insurance. Note, that Murray N. Rothbard (1926–1995) was a defender of the return of the gold standard, like, for instance, US Congressman Ron Paul still is. Although understandable, seen from a historical US’ perspective, a money system based on gold has many disadvantages. Countries without gold mines would have to buy gold (which means deliver goods and services to the gold mining countries) for the only purpose of disposing of a national means of payment. Each time when more gold comes on the market, they will be obliged to buy more of it, to prevent their currency to devaluate against currencies of countries with increasing gold stocks. The gold mining industries would, in many aspects, get supra-national power, even more than the Fed today. Gold has no stable value. Its pricing can be influenced by holders of big stocks, like the gold mining industries and central banks. Even big numbers of small buyers and sellers, when triggered by fear or greed, can influence its price. All these price fluctuations can form a danger for any economy that has its money pegged to gold. Still more than today, gold would trigger conflicts, oppression and wars.

[4] Bank crisis? Reform! (http://www.courtfool.info/en_Bank_crisis_Reform.htm)

[5] Secrets of money, interest and inflation (http://www.courtfool.info/en_Secrets_of_Money_Interest_and_Inflation.htm)

[6] Energy crisis: turning-point of humanity (http://www.courtfool.info/en_Turning_point_of_humanity.htm)

Is the Euro Doomed? (2)

06/11/09 Baltimore, Maryland

Despite all the U.S.’ woes, the dollar is holding pretty steady. The dollar index is just a hair lower than yesterday, now at 79.8. Thus, the dollar’s major competitors are just a few cents off recent 2009 highs… euro: $1.40, pound: $1.64, yen: 97.

Interestingly, the pound is currently at a 2009 high versus the euro, at 85 pence. Trader fears are mysteriously shifting out of the U.K. and into Europe, where the “one currency fits all” model is again in question.

“It only makes sense,” writes our currency trader Bill Jenkins, “that given the present situation, a country like Ireland should not be able to borrow at the same rate as a country like Germany. Yet that has been the very working policy of the ECB. One size fits all. Everybody borrows at the same rate, so theoretically, as they put that money to work, they all profit at the same rate. It supposedly provides some synchronicity to the economies. The only problem is, it doesn’t.

“Germany is putting the squeeze on other members. The more trouble the PIGS (Portugal, Ireland, Greece and Spain) are in financially, the worse they feel the squeeze of Germany’s unrelenting and strong fiscal discipline. And it provides yet another reason for Germany to exit the Union. Simply staying on just to feed the PIGS isn’t going to do it.

“At the same time, the incentive for the PIGS to join the Union in the first place was to piggyback on the strength of the Germans — it offered them lower rates at which to borrow. Now they are seeing rising rates, as they are forced to borrow outside the ECB. Rising rates with a stable currency they cannot control forces them to lower wages on their citizens as the only outlet for financial pressures. No politician wants falling wages on his term record!

“In short, I don’t think the euro has any lasting strength in the years ahead.”

Is the Euro Doomed?

Solution of Last ResortIs the Euro Doomed?

By LAURENT JACQUE

Will the tsunami devastating the global financial system undermine the stability of the euro? Its advocates say not. Doomsday scenarios of a partial break-up of the Eurozone have, as yet, failed to materialise. They argue that, over 10 years, the Eurozone has become a haven of peace and stability giving the second world economy a stable currency. In January, the Eurozone acquired its 16th member, Slovakia. And even the Eurosceptics (Denmark, Sweden and the United Kingdom) who snubbed the launch of the single currency in 1999 are having second thoughts: the Danish crown may join up shortly.

The independent European Central Bank (ECB) has single-handedly reined in the growth in the money supply, bringing inflation down to approximately 2 per cent. Average nominal interest rates have stabilised at around 2.5 per cent, while real interest rates are at their lowest since the 1960s. And the abolition of 15 national currencies eliminated exchange risks (1) and transaction costs, galvanizing intra-euro zone trade and investment, which now form a third of its GNP.

In 2008 the euro reached its high against the dollar as the pound collapsed and Iceland went bankrupt. Reassuringly for those in the Eurozone, the euro is emerging as an alternative to the mighty dollar: today it accounts for more than a quarter of all central banks’ foreign exchange reserves and has become the currency of choice, ahead of the dollar, for all international bond issues. As ECB chairman Jean-Claude Trichet said cheerfully: “We are contributing every single day to an ever-higher level of prosperity and we are therefore playing a critical role in the unification of Europe” (2).For all these glittering achievements, there are signs of malaise. During the last decade the Eurozone’s economic growth was sluggish, unemployment continued stubbornly high and many EU members’ budgetary deficit exceeded the 3 per cent GDP ceiling mandated by the Growth and Stabilisation Pact. By contrast, the Eurosceptics had far lower rates of unemployment (half the Eurozone average), higher growth rates and very low budget deficits (if not surpluses).

The euro has failed to deliver any significant benefits to Eurozone countries, mainly because of structural economic problems for which the euro was never meant to be the panacea. Even so, hopes of reduced unemployment or higher economic growth have not come true. So could the euro be partly responsible for the vicissitudes of the last decade? And will it survive unscathed the crisis engulfing the global economy?

The launch of the euro in 1999 was a politically motivated event which never met the acid test of what economists call an “optimal currency area”. A group of countries (or regions) is deemed to constitute an optimal currency area when their economies are closely interwoven by trade in goods and services, and characterised by mobility of capital and labour. The United States is the longest surviving and most successful example of a well-functioning currency area.

Is the European Union also an optimal currency area? Intra-EU trade hovers at around 15 per cent of the Eurozone’s GNP – significant but considerably lower than in the US. While footloose capital is increasingly the EU norm, labour mobility across Europe is only a fraction of what it is in the US and remains very low within each of its national economies.

Ignoring these problems, the EU launched the euro in 1999 and created a single monetary policy, establishing a central bank and depriving each country of two (out of three) critical policy instruments: an independent monetary policy to tame inflation or spur growth through interest rate adjustments and a flexible exchange rate to keep its economy competitive.

Furthermore, fiscal policy – the third critical instrument – is sharply constrained by the Growth and Stabilisation Pact which caps the budget deficit for each country at 3 per cent of GDP. National debt should not exceed 60 per cent of GDP, with notable exceptions such as Italy and Greece, which breached the ceiling at 104 per cent and 95 per cent of their GDP respectively. Structural and cyclical differences between individual EU members are clear; so the Eurozone’s reduced economic policy deftness is of particular concern in the event that one member country suffers an economic shock that does not affect the rest.

If the Eurozone were really an optimal currency area, a country in trouble would be able to adjust through the mobility of its labour force within the rest of the Eurozone, the flexibility of wages and prices, and/or a budgetary transfer from Brussels to help it out. None of these conditions were met when the euro was first launched, nor is there any sign that member countries are putting in motion structural reforms to bring the Eurozone any closer to becoming an optimal currency area.

The third condition – which is easier to meet – calls for a hefty dose of “fiscal federalism” and would transfer significant taxing and spending power away from national governments to the EU. This transfer remains elusive for fear of further diluting national sovereignty.

Indeed the EU – which itself has limited taxing power (no more than 1.27 per cent of GNP) – cannot make stabilizing fiscal transfers to smooth out national shocks. The brunt of the responsibility for fiscal policy remains in the hands of national governments, with Brussels accounting for less than 3 per cent of Eurozone government expenditures.This stands in stark contrast to the United States where more than 60 per cent of government expenditures occur at the federal level. The US also has high labor mobility and greater wage flexibility than Europe. Even Germany’s reunification, which joined east and west in a single mark in 1991, hardly created an optimal D-mark zone: in spite of fiscal transfer in excess of 200bn euros over a 10-year period, unemployment remained stubbornly high (close to 20 per cent) in East Germany.

In its first 10 years the Eurozone has experienced at least two main “asymmetrical” shocks which did not impact all its members uniformly: the overvalued dollar from 1999-2002 and the oil shock from 2005-8. In the case of the dollar, those Eurozone countries dependent on international trade have experienced faster imports-induced inflation than those oriented to Eurozone trade. Ireland – more of an international than a European trader – experienced inflation at the rate of 4.1 per cent over the 1999-2002 period, whereas Germany – more of a European than an international trader – remained in the slow inflation lane at 1.2 per cent over that same period.

Similarly, the quadrupling of the price of crude oil is impacting on national rates of economic growth and inflation more or less in proportion to their dependence on oil. France, with its lower dependence on oil (35 per cent of its energy supply because of its high dependence on nuclear power), is less affected than Greece, Ireland, Italy, Portugal or Spain, which rely on oil for more than 55 per cent of their energy supply.

The combination of centralized monetary policy and decentralized fiscal policy is resulting in localized differences in inflation which are affecting the euro’s purchasing power in each Eurozone country. Under a national exchange rate, this is easily corrected through monetary policy and “competitive” depreciation/appreciation of the national currency. But this is no longer a possibility: the straightjacket of the euro killed the exchange rate policy instrument and froze monetary policy at the national level. Because of this inability to respond flexibly to inflation, the purchasing power of the euro is rapidly eroding in several countries.

On the basis of labour cost indices in Italy and Germany over the period 1 January 1999 to 30 September 2008, the euro in Italy is overvalued by 41 per cent against the euro in Germany, and Spain and Greece are not far behind. Unless countries suffering from overvaluation can correct the problem through faster gains in productivity and/or wage and price downward flexibility, the problem is not reversible. More importantly, overvaluation is a cumulative process which becomes harder to correct over time. In this vein, the latest round of EU enlargement may – to a limited extent – bring about some price and wage downward flexibility to the Eurozone as firms can make increasingly credible threats to outsource from or to relocate manufacturing operations to Eastern Europe to take advantage of cheaper labour.

To make matters worse, EU countries cling to their own electoral calendars for presidential, parliamentary or municipal elections. This exacerbates cyclical discrepancies across the Eurozone: the run-up to an election is often accompanied by expansionary fiscal policy.

As the world economy digs itself in a deeper hole, the main economic policy goal is becoming to combat the relentless rise of unemployment, which could rapidly reach 10-12 per cent. Spain’s unemployment has already skyrocketed to 13 per cent in the last six months. But fighting unemployment will result in massive budget deficits, which will unravel the Stabilisation Pact and jeopardise the stability of the single currency. Stimulus plans that are being implemented are blowing big holes in the deficit ceiling set at 3 per cent of GDP, pushing national debts way beyond the threshold of 60 per cent of GDP and raising new threats to the independence of the ECB.

Under duress, and facing the bleak prospect of a prolonged economic crisis and deepening structural unemployment, some countries may be tempted to follow the example of the brutal devaluation of the pound. Greece, Italy, Portugal and Spain (whose unemployment often exceeded 10 per cent in the last decade) will not agree to remain “under-competitive” because of the “over-valuation” of the euro.

However traumatic it may be to reinstate national currencies, some countries could decide to abandon the euro to recover their economic competitiveness. This scenario is reminiscent of the major currency crises that rocked the Bretton Woods system of fixed exchange rates between 1944 and 1971, and more recently the European Monetary System from 1979-99 (3). But this is unlikely in the short term, if only because national debts denominated in euros would become very expensive to service with a newly restored but devalued currency for the seceding country. Even so, further deterioration of an already fragile social climate (such as the recent demonstrations in Greece) fuelled by a brutal acceleration of unemployment, may push some countries to this solution of last resort.

Laurent Jacque is the Walter B Wriston professor of international finance and banking at the Fletcher School (Tufts University, US) and HEC School of Management (France)

Notes.

(1) Risks due to exchange rate fluctuations. Prior to the creation of the euro, investors would routinely speculate against the franc, lire or pound. In September?1992, George Soros successfully speculated against the pound as the United Kingdom abandoned the European Monetary System.

(2) Interview in Die Zeit, Hamburg, 23?July?2007.

(3) The European Monetary System was established in 1979and aimed at stabilising exchange rates among European currencies, in effect re-enacting on a European scale the Bretton Woods system of pegged exchange rates. Each currency was pegged to an artificial currency unit known as the ecu, the predecessor of the euro.

This article appears in the March edition of the excellent monthly Le Monde Diplomatique, whose English language edition can be found at mondediplo.com. This full text appears by agreement with Le Monde Diplomatique. CounterPunch features one or two articles from LMD every month.

Tuesday, May 19, 2009

Κίνδυνος χρεοκοπιών στην ευρωζώνη

Ta Nea On-line

©Τhe Τimes, 2009

19-05-09

ΤΗΝ ΠΕΡΑΣΜΕΝΗ Παρασκευή η Ευρωπαϊκή Επιτροπή δημοσίευσε τις πιο καταστροφικές οικονομικές στατιστικές που έχει ανακοινώσει ποτέ επίσημη αρχή από το 1945. Τα στοιχεία αυτά έδειξαν ότι η Γερμανία υπέστη τη μεγαλύτερη οικονομική συντριβή που έχει καταγραφεί ποτέ σε μεγάλη βιομηχανική χώρα. Τα ίδια στοιχεία έδειξαν ότι αρκετές από τις χώρες της Κεντρικής Ευρώπης αλλά και της περιφέρειας στην ευρωζώνη αντιμετωπίζουν οικονομική κατάρρευση.

Η «τέλεια καταιγίδα»

Τρία στοιχεία έχουν δημιουργήσει την «τέλεια καταιγίδα» στην Ευρώπη:

Το πρώτο είναι η εξάρτηση της Γερμανίας απο τις εξαγωγές. Σε μια περίοδο παγκόσμιας μείωσης στη ζήτηση, αυτό εξελίχθηκε σε αχίλλειο πτέρνα της χώρας.

Το δεύτερο είναι ο απερίσκεπτος δανεισμός στην Κεντρική Ευρώπη και τη Βαλτική, ιδιαίτερα από τράπεζες που έχουν έδρα την Αυστρία, τη Σουηδία, την Ελλάδα και την Ιταλία οι οποίες με τη σειρά τους δανείζονταν από Γερμανούς επενδυτές και τράπεζες.

Το τρίτο στοιχείο είναι το ίδιο το ευρώ. Την πρώτη δεκαετία της ύπαρξής του, το ενιαίο νόμισμα συνεισέφερε στην ανάπτυξη επιτρέποντας σε χώρες όπως η Ισπανία, η Ελλάδα, η Πορτογαλία, η Ιρλανδία και η Δανία να διατηρούν τεράστια ελλείμματα στο ισοζύγιο τρεχουσών συναλλαγών και να απολαμβάνουν έκρηξη στην αγορά ακινήτων και τον δανεισμό. Η ανάπτυξη αυτή δημιούργησε αγορές για προϊόντα που παράγονταν στη Γερμανία όπως αυτοκίνητα και άλλα αγαθά.

Τους τελευταίους μήνες όμως το ευρώ από παράγοντας σταθερότητας έγινε παράγοντας αστάθειας και πλέον οι κυβερνήσεις στην ευρωζώνη, αν φτάσουν στο απροχώρητο, δεν μπορούν να τυπώσουν χρήμα για να πληρώσουν τα χρέη τους όπως μπορούν να κάνουν χώρες εκτός ενιαίου νομίσματος. Απειλητική τραπεζική κρίση

Ο κίνδυνος χρεοκοπίας είναι ιδιαίτερα σοβαρός για κυβερνήσεις που αντιμετωπίζουν μεγάλη τραπεζική κρίση. Στην Ιρλανδία, την Ελλάδα και την Ισπανία, οι κυβερνήσεις αναγκάστηκαν να εγγυηθούν για τράπεζες με υποχρεώσεις μεγαλύτερες του κρατικού προϋπολογισμού. Στην Αυστρία, την Ελλάδα και την Ιταλία, μάλιστα, οι κίνδυνοι αυτοί έχουν μεγεθυνθεί από την έκθεση των τραπεζών στην Κεντρική Ευρώπη.

Η οικονομική κατάρρευση στην Κεντρική Ευρώπη είναι σχεδόν σίγουρο ότι θα δημιουργήσει κύμα χρεοκοπιών από δάνεια.

Αυτό θα μπορούσε, με τη σειρά του, να φέρει καταστροφή στο ευρωπαϊκό τραπεζικό σύστημα και να αυξήσει την πιθανότητα κρατικών χρεοκοπιών στην Ελλάδα, την Αυστρία, την Ιρλανδία και άλλες χώρες της ευρωζώνης.

Ο καλύτερος τρόπος να βγει από την κρίση η Ευρώπη, είναι να εγκαταλείψει η Γερμανία την αυστηρή δημοσιονομική πειθαρχία, να λάβει νέα δημοσιονομικά μέτρα μεγάλης έκτασης και να εγγυηθεί τα χρέη όλων των εταίρων της στην ευρωζώνη. Οι κυβερνήσεις, όμως, δεν λειτουργούν πάντοτε με γνώμονα τη λογική, όπως απέδειξαν οι ΗΠΑ που άφησαν τη Lehman Βrothers να καταρρεύσει. Ελπίζω να έχουμε μάθει το μάθημά μας τους τελευταίους δώδεκα μήνες.

Saturday, May 2, 2009

Greeks seek refuge in coffee shops amid slump

Greeks seek refuge in coffee shops amid slumpApr 20, 2009

ATHENS (AFP) — Determined to keep their cheer in the gloom of the economic downturn, Greeks are holding on to the nation's unofficial shrink couch -- the coffee shop -- for a few hours of escape from their bills.

At a time when hundreds of small businesses around the country teeter in a market plagued by falling consumer demand and a loan drought, cafeterias are doing a brisk trade with millions refusing to forego their daily coffee fix.

"Crisis or not, Greeks will have their coffee," said Phaedon Vaimakis, 29, a junior financial analyst enjoying his cup on a warm Athens spring afternoon.

Though not a coffee producer, the country swears by the bean -- Greeks go through an estimated 5.8 billion cups a year whether on a date, a business appointment or just to get out of bed in the morning...

Greeks seek refuge in coffee shops amid slump